recently, tata consultancy services (tcs) had announced buyback of shares which increased the traders and investors interaction with these shares. so in this article you'll get to know about some of the aspects of buyback of shares, tcs buyback of shares and benefits of buyback.

what is buyback of shares?

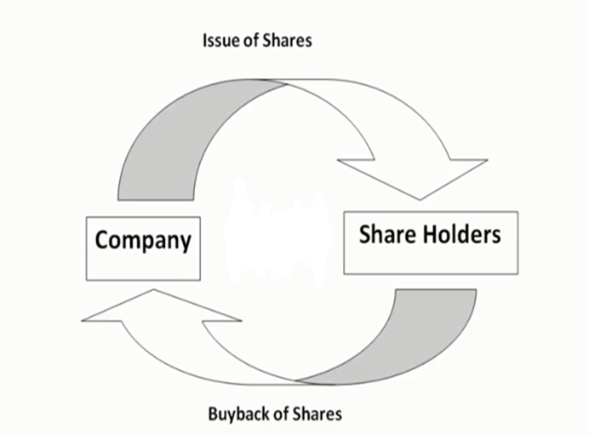

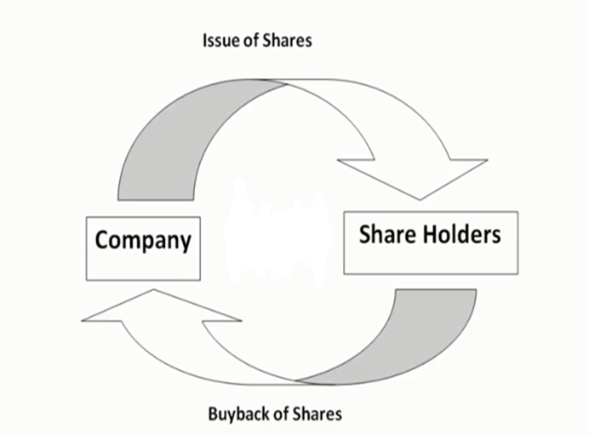

a company have so many authorities to take any corporate action in related to stock market regarding its shares as buyback of share is one of them. so share buyback is a corporate action in which a company buys its shares again from its share holders or investors by providing a good and attractable offer. in short repurchasing of shares of its own company is buyback of shares. however companies mostly take this action because they think that their share price is getting undervalued. now companies can buyback their shares through two types that is tender offer buyback and open market buyback.

in tender offer buyback companies announce a record date on which the eligible participants can sell their shares to the company again at a decided price. so if someone wants to participate in the offer then he have to be eligible for the participation. those who have shares in their demat account prior to the record date would be eligible for the offering of shares. here the tender offer get's announced at higher price than the average current market price (cmp) as if company will not pay higher for the share than cmp then why will one sell the share back to the company. after the record date company gave 10 days of time to the investors to offer their shares to the company. after some days the participant get an email from which he can get to know that how much of his shares get accepted and how much of them get declined as these companies set a ratio of buying back of share. so if they get higher amount of share, then they accept shares from all the investors at a equal ratio and decline the other shares and return it to the investors.

in open market buyback companies buyback its shares from stock exchanges directly like a normal investor. in the open market buyback the companies announces the number of shares that they are going to occupy again and the price limit under which the buyback will be held. for example if a company announces the buyback of shares at rs 100 then it will buy the shares under 100 rs or at 100 rs but if the share price exceeds 100 rs then it will immediately stops the buyback procedure. in this method companies get 6 months of period for taking its shares from the market, so these companies buy a particular amount of shares on daily basis from the stock exchanges and there is no interference of general investors in these mode of buyback.

why do company buyback its shares?

there are various reasons for which companies buyback their shares from the market some of them are shares undervaluation, financial ratio, employees appreciation, etc.

undervaluation of share price refers to that the share of a company is getting traded at lower market price than its real value. so when companies thinks that the market price of there shares is getting low from its real value at that time companies buyback there shares at that low price and use the reserved cash properly. however on the other hand it helps the investors as there ownership get increased in the company due to reduction in shares.

it is the another reason why companies do buyback, when companies wants to increase there earning per share at that time they do buyback of shares. however while doing this the price to earning ratio (p/e ratio) get decreased.

benefits of buyback to investors :-

- in tender offer buyback, companies used to offer high price for each share then the average current market price. because if they don't provide higher amount for the share then why should an investor sell it back to the company. here the companies cannot pressurize their stakeholders to sell there shares to the company, that is why they provide a good and attractable offer to the shareholders.

- if an investor did not participate in the tender offer buyback then also there are chances that he can make money directly through his shares as it is completely on the shareholders will that they wants to sell their shares or not. other than that buyback also increases the dividend yielding capacity of each share. currently, apple inc. is the first company which had repurchased its own shares for the highest times, in recent years it had paid $85.5 billion to repurchase its own shares.

- generally most of the companies do buyback when they thinks that the value of share of their company is getting traded at low market value than its real price, so there are highly chances of increase in share price after the buyback. those who didn't sell there shares in buyback can expect higher returns directly through there share after the buyback ends.

tcs buyback of shares :-

recently tcs had announced buyback of shares of worth rs 18,000 crores at a price of 4,500 rs per share. the announcement was done in january 2022 and the record date for the closing and offering of shares is 23rd of february. so if any investor wants to offer his shares for the buyback then he have to be eligible by buying the shares 3 days prior to the record date.

from the date tcs get listed as public company it had done 3 times buyback of shares for the first time it buyback its shares in year 2017 at the offered price of rs 2,850 when its price was 2,400 per shares it means they provide 17% of premium in buyback, for the second time in year 2018 it repurchased its shares at rs 2,100 when its cmp was 1,800 rs at that time they provided the premium of 16% and for the third time it repurchased its shares in year 2020 at that time the offered price is of rs 3,000 when its average cmp is of rs 2,715. currently, it's the 4th time that tcs repurchasing its shares at buyback price of rs 4,500 and the price of share when buy back was announced is of rs 3,840. currently it is providing around 17% of premium again to its offered shareholders.

as the tcs buyback news get viral the volatility of the share also get increased. in january 2022 it get to the 52 week high that crossed 4,000 rs. as the tcs buyback price was announced at rs 4,500 with the total shares worth rs 18,000 crores it is said to be that 4,00,00,000 shares will be repurchased by the company this time.

0 Comments